change in net working capital cash flow statement

A company uses its working capital for its daily operations. To calculate free cash flow another way locate the income statement balance sheet and cash flow statement.

Image Result For Cash Flow Statement Template Contents Cash Flow Statement Financial Ratio Financial Statement Analysis

Therefore an analysis of factors bringing about a change in the amount of net working capital is useful for decision-making by shareholders creditors.

. The change in working capital is the difference between a firms current WC and its previous WC. Change in Working Capital Cash Flow Statement Operating net working capital can be viewed as the amount of cash tied up in the net funding of inventory accounts receivable and accounts payable. There would be no change in working capital but operating cash flow would decrease by 3 billion.

Failure to monitor changes in working capital can lead a. If Changes in Working Capital is positive the change in current operating liabilities has increased more than the part of the current assets. Changes in working capital -2223.

So a positive change in net working capital is cash outflow. Hence a funs flow statement based on the concept of net working capital fits well with other statements. And this reduces Free Cash Flow.

The Change in Working Capital gives you an idea of how much a companys cash flow will differ from its Net Income ie after-tax profits and companies with more power to collect cash quickly from customers and delay payments to suppliers tend to have more positive Change in Working Capital figures. How working capital affects cash flow. Changes in working capital are reflected in a firms cash flow statement.

For most companies you analyze by using the change in working capital in this way the FCF calculation and owner earnings calculation is similar as it was for Amazon and Microsoft. The cash flow statement changes in working capital is the summary of working capital changes that go on during a period in a company. In 3-statement models and other.

That change can either be positive or negative. So if the change in net working capital is positive it means that the company has purchased more current assets in the current period and that purchase is basically outflow of the cash. By definition Net Working Capital does include cash as it is defined as Current Assets - Current Liabilities.

B Cash flow to creditors is defined as. A hybrid three-statement model allows companies to efficiently gain visibility and predictability to future cash positions through connected financial statements. Above all working capital is also a measure of the short-term liquidity of the firm.

Year-over-year or quarter-over-quarter helps assess the degree to which a companys free cash flows. Now changes in net working capital are 3000 10000 Less 7000. Here are some examples of how cash flow and working capital can be affected.

Start with net income and add back charges for depreciation and amortization. If you wanted to you could recreate the cash flow. Imagine if Exxon borrowed an additional 20 billion in long-term debtboosting the current amount of 244 billion to 444 billion.

Similarly change in net working capital helps us to understand the cash flow position of the company. Changes in working capital are reflected in a companys cash flow statement. This cash flow is shown as part of the cash flow statement under the heading operating cash flow.

This left some scrambling as they couldnt model the impact of changes in working capital with their traditional forecasting methods. For the year 2019 the net working capital was 7000 15000 Less 8000. It is important for a business to have a simple system to monitor working capital and changes in working capitol by for example calculating working capital as a percentage of sales.

We subtract out the change in WC from net income because a positive difference between new and old working capital would be a cash outflow whereas a negative difference would be a cash inflow to the. If a transaction increases current assets and current liabilities by the same amount there is no change in working capital. Understanding customer item and vendor behaviors.

On the cash flow statement the changes in NWC are essential because tracking these changes over time eg. For year 2020 the net working capital is 10000 20000 Less 10000. An increase in net working capital reduces a companys cash flow because the cash cannot be used for other purposes while it is tied up in working.

This means the use of cash has been delayed which increases Free. In this case the change is positive or the current working capital is more than the last year. You can calculate the change in net working capital between two accounting periods to determine its effect on the companys cash flow.

Owner Earnings 8903 14577 5129 13312 2223 13084. Since we have defined net working capital we can now explain the importance of understanding the changes in net working capital NWC. Here are some examples of how.

The section of the cash flow statement is where the changes in working capital live and breathe. Now it depends what you want to do with it.

Cash Flow From Investing Activities 2 2 Cash Flow Statement Cash Flow Investing

13 Free Excels Download Free Premium Templates Cash Flow Statement Business Valuation Cash Flow

Cash Flow Statement Template Google Docs Google Sheets Excel Word Apple Numbers Apple Pages Pdf Template Net Cash Flow Statement Statement Template Profit And Loss Statement

There Are 3 Types Of Financial Statements Cash Flow Statement Financial Position Financial Statement

Cash Flow Formula How To Calculate Cash Flow With Examples Cash Flow Positive Cash Flow Formula

Example Cash Flow From Investing Activities Alphabet Inc Cash Flow Statement Cash Flow Investing

Understand Cash Flow Impact And Financing Of Business Growth Cash Flow Statement Business Growth Understanding

Free Cash Flow Cash Flow Cash Flow Statement Positive Cash Flow

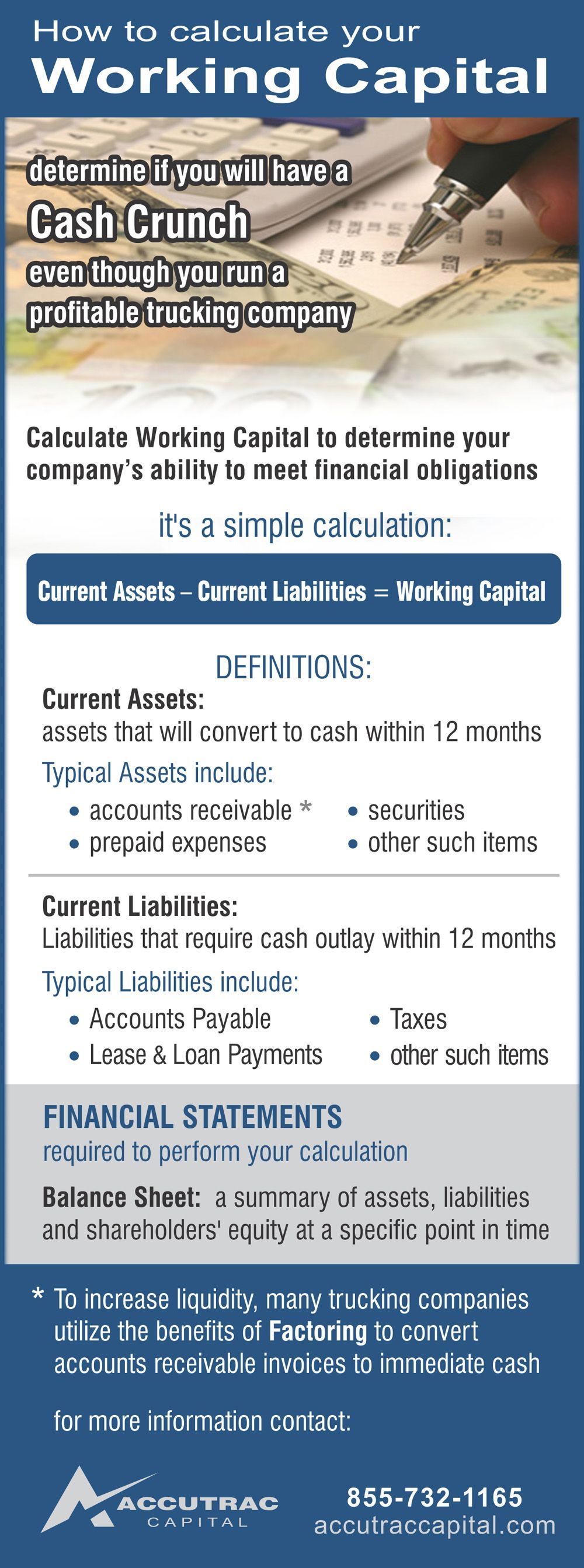

Have You Determined If You Have Enough Working Capital To Run A Profitable Trucking Comp Bookkeeping And Accounting Accounting And Finance Financial Management

Cash Flow Statement Indirect Method Cash Flow Statement Positive Cash Flow Cash Flow

Cash Flow From Operating Activities 3 3 Cash Flow Statement Cash Flow Cash

How To Prepare Fund Flow Statement Fund Accounts Receivable Accounts Payable

Cash Flow Formula How To Calculate Cash Flow With Examples Cash Flow Positive Cash Flow Formula

Accounting Taxation Working Capital Management Full Info Capital Requirement Operating Cycle Gross Net W Management Capital Finance Financial Accounting

Types Of Cash Flows Cash Flow Statement Cash Flow Investing

Example Cash Flow From Financing Activities Alphabet Inc Cash Flow Statement Business Valuation Financial Modeling

Net Cash Change In Cash Flow Statement Should Tie To Cash Reported In The Balance Sheet Cash Flow Statement Cash Flow Balance Sheet

Free Cash Flow Cash Flow Cash Flow Statement Positive Cash Flow