virginia electric vehicle tax credit 2022

The West Virginia National Electric Vehicle Infrastructure NEVI Deployment Plan. DETROIT AP A tax credit of up to 7500 could be used to defray the cost of an electric vehicle under the Inflation Reduction Act now moving toward final approval in.

A Bigger Tax Credit For Going Electric What It Could Mean For Consumers Forbes Wheels

Electric Suppliers Corporation Minimum Tax and Credit Schedule 500EL Instructions.

. At least 31 new 2022 and 2023 EV models qualify for up to 7500 in tax credits that could be used to defray the cost of purchasing an electric vehicle. 2022 1103 AM. Must purchase and install by December 31 2021 and claim the credit on your federal tax return.

BEV and PHEV cars purchased in or after. The surprise deal by Senate Democrats on a pared-down bill to support families. WV News The West Virginia Department of Transportation has completed a preliminary plan of proposed locations for electric vehicle charging stations and submitted it to the federal government.

Used electric vehicle purchases are eligible for a 500 EV. Colorados electric vehicle tax credits have been extended with a phaseout in place for purchases of electric vehicles in the following years. For electric transporters electric SUVs or electric pickups the price limit is 80000 according to Electrek.

Other restrictions on the subsidy concern the price of eligible vehicles. For example consider a new vehicle that costs 15000. Electric Supplier Minimum Tax and Credit Schedule Instructions 500FED.

A tax credit of up to 7500 could be used to defray the cost of an electric vehicle under the Inflation Reduction Act now moving toward final approval in Congress. Under the Inflation Reduction Act nearing final approval in the US. Electric Vehicle Tax Credit.

The City of Flagstaff has a Sustainable Automotive Rebate Program that will rebate a portion of the local tax paid for purchases of fuel-efficient automotive vehicles. The Illinois EPAs Electric Vehicle Rebate Program application opened on July 1 2022. And only people with an adjusted gross income of less.

Electric Cooperative Modified Net Income Tax Return Instructions 500EL. If two bills in two years have proposed electric vehicle rebate programs that would apply to virtually no cars. Add to that an income cap of who can claim the tax credit.

Joe Manchin announced in late July includes a proposal to extend a 7500 tax credit toward the. 150000 if youre single or 300000 if you joint-file tax returns. Best Electric Cars for 2022.

Ford is raising sticker prices for electric vehicles by 6000 to 8500. FILE - A sales associate talks with a prospective buyer of a Cooper SE electric vehicle on the showroom floor of a Mini dealership July 7 2022 in Highlands Ranch Colo. Price hikes announced for new electric vehicles are roughly equal to the amount of the tax credits.

Regarding the original tax credit according to the IRS For vehicles acquired after December 31 2009 the credit is equal to 2500 plus for a vehicle which draws propulsion energy from a. 2022 you can get a 2500 EV rebate in the state of Virginia on new electric vehicle purchases. DETROIT AP A tax credit of up to 7500 could be used to defray the cost of an electric vehicle under the Inflation Reduction Act now moving toward final approval in.

A tax credit of up to 7500 could be used to defray the cost of an electric vehicle under the Inflation Reduction Act now moving toward final. The US Federal Tax Credit gives individuals 30 off a ChargePoint Home Electric Vehicle charging station plus installation costs up to 1000. You trade in your old vehicle and receive a 6000 credit.

Electric sedans are only eligible for the tax credit up to a price of 55000 according to the draft. Medium duty electric truck. Light duty passenger vehicle.

Electric Vehicle Rebate City of Flagstaff. Writing for Reason Joe Lancaster noted that President Joe Bidens initial Build Back Better proposal included a tax credit that would have applied to all of one vehicle the Chevrolet Bolt. A Cooper SE electric vehicle is on the showroom floor of a Mini dealership July 7 2022 in Highlands Ranch Colo.

Congress a tax credit of up to 7500 could be granted to lower the cost of an electric vehicle. The surprise deal by. Electric vehicle manufacturers say a proposal to extend tax breaks to purchasers of electric vehicles would not include most of the models currently on the market.

Which Senate Majority Leader Chuck Schumer and West Virginia Democratic Sen. The out-of-pocket cost for the new vehicle is 9000 after trade-in. Light duty electric truck.

Now not one single vehicle qualifies for the full rebate he wrote.

10 Most Affordable Electric Cars In 2022

Report Build Back Better Bill Could Stall In Senate For Months Delaying Expanded Ev Tax Credit

A Bigger Tax Credit For Going Electric What It Could Mean For Consumers Forbes Wheels

Proposed Ev Tax Credit For Union Made Vehicles Is No More

Electric Cars With The Longest Range On Sale Now In The Us

The 12 500 Ev Tax Credit 2022 Everything You Need To Know Updated Yaa

9 Best Electric Vehicles Under 50k For 2022 Truecar

Best New Electric Cars For 2022 And Beyond Greencars

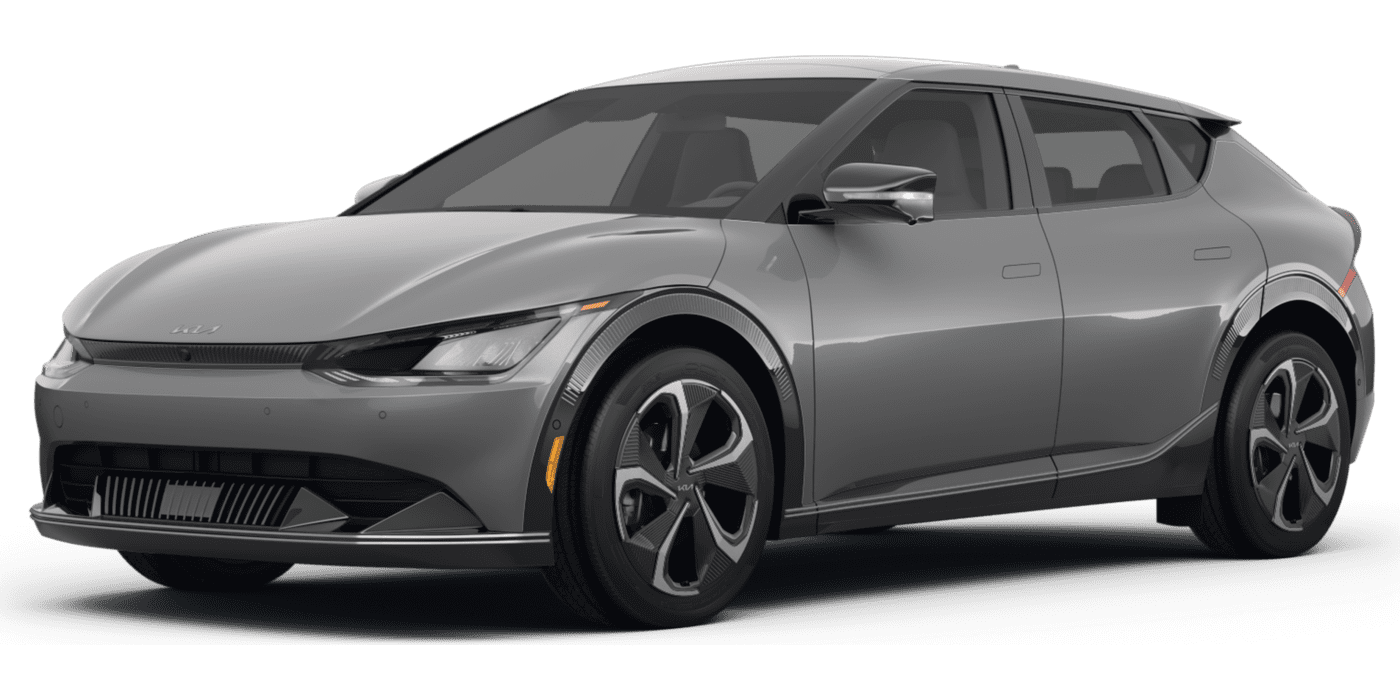

2022 Kia Ev6 Suv Preview Release Date Price Electric Range Specs

Proposed Ev Tax Credit For Union Made Vehicles Is No More

Shares Of Ev Start Up Lucid Jump On New Reservations 2022 Production

Electric Hybrid Car Tax Credits 2022 Simple Guide Find The Best Car Price

Proposed Ev Tax Credit For Union Made Vehicles Is No More

The Best Hybrid Electric Vehicles For 2022 According To Us News World Report Cleantechnica

Joe Manchin Says Ludicrous Electric Vehicle Tax Credit Not Needed Bloomberg

Electric Vehicle Tax Credits What To Know In 2022 Bankrate

The 10 Cheapest Electric Cars You Can Buy In 2022 Ford Chevy Nissan